We Analyzed 5625 B2B SaaS CTAs, This Is What We Found

CEO, Co-Founder

In B2B SaaS, your customer's first interaction with your product is critical. How are you encouraging visitors to experience your product? What language are you using to communicate that? How does your call to action (CTA) relate to the peers in your industry?

To dive deeper into these questions, we analyzed data from 5625 B2B SaaS sites. To collect this information, we researched website text and where necessary, supplemented it by manual inspection of each companies' page. Broadly, these are U.S.-based companies with 11-32,000 employees. Let's dig into what we found.

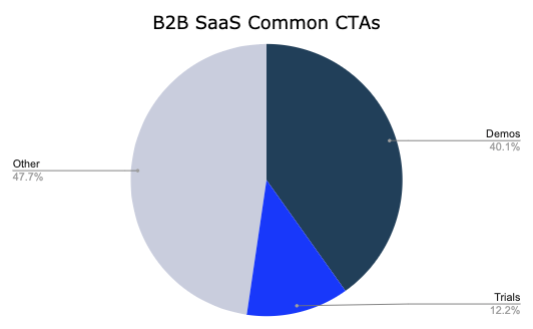

Demos vs Trials

Of the 5625 companies, ~40.1% had a demo-based call to action (CTA). 47% had assorted CTAs non-specific to trials or demos ("contact us", "get in touch", "request information", etc). Trial-based CTAs came in around 12.2%.

Why do only 12.2% have trial-based CTA? The data reveals that demos still dominate the enterprise sales motion. Given the manual setup required (integrations, team-wide installation, data security requirements, etc), most enterprise software has yet to convert to the increasingly consumerized, trial-based selling motion.

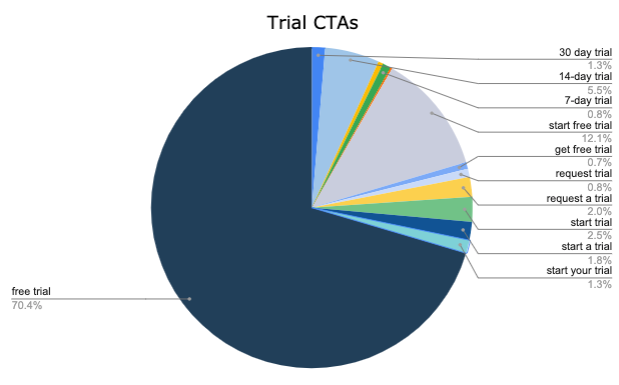

Trials

Let's first start by looking at what Trial CTA B2B companies are using.

It appears the "Free Trial" CTA wins by a long shot, followed in a distant second by "start free trial." Noticeably, experiences that require a delay in experiencing the product ("Request a trial") are a far minority here.

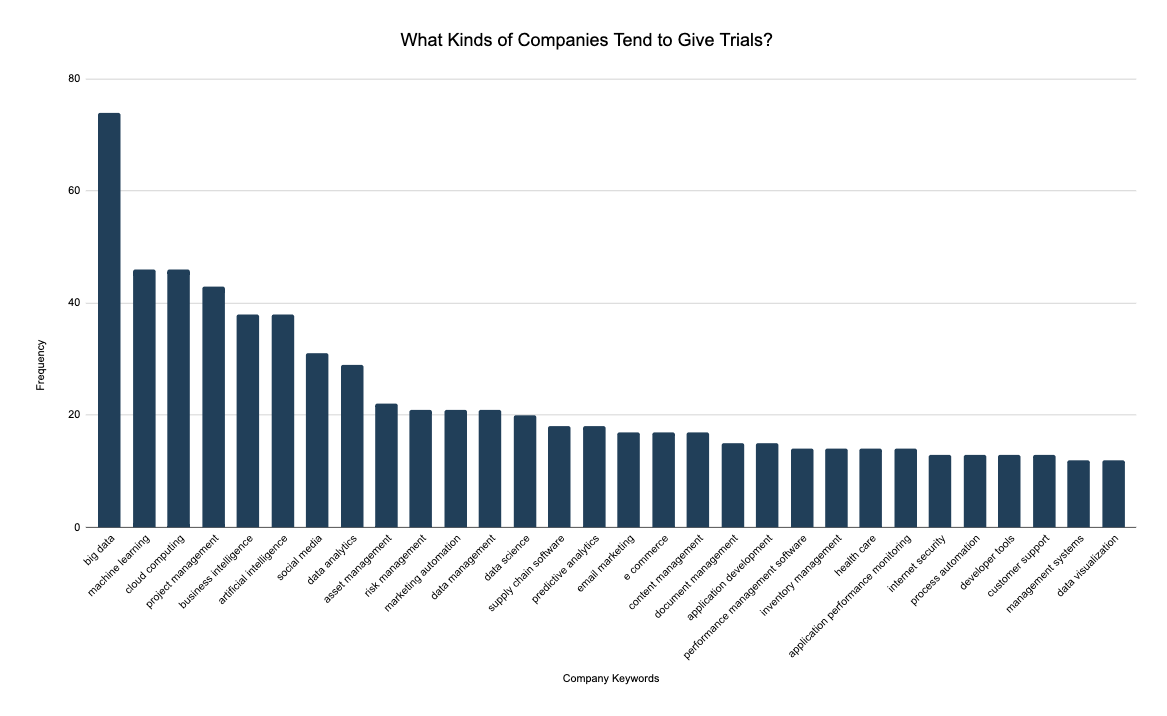

Let's dig a bit deeper. What sort of B2B software has been shifted to the trial-based selling motion?

Let's look at the data.

As we can see from this graph above, analytics-based tools have a strong showing (Business Intelligence, Data Analytics). This makes sense. The hyper-competitive analytics & BI market has turned the customer experience for these tools into a pre-requisite for the deal. Here are the other kinds of tools that ranked highly:

- Cloud Computing

- Project Management

- Social Media

- Collaboration/Content Management

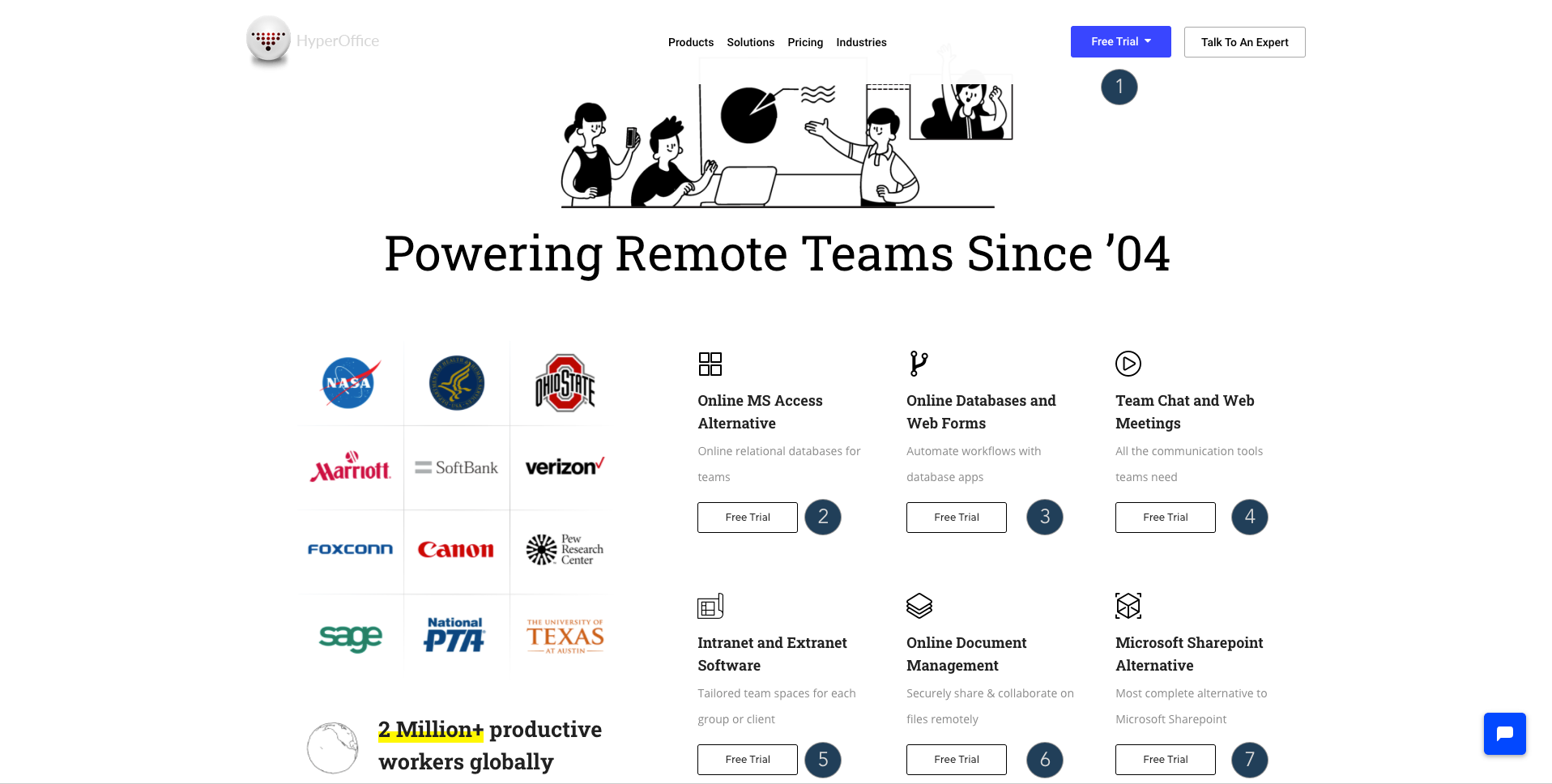

Let's look at an example. In the collaboration space, HyperOffice has a broad suite of tools. They've taken an interesting approach to sharing their call to actions. If you examine the page, you'll see 7 CTAs - all on the landing page!

And not only that, they've also added impressive usage stats, customer references and a strong headline. With a 25-55% bounce rate for B2B sites (source), HyperOffice ensures that users only seeing the landing page have the following understanding:

- They're an established company designed for remote teams

- HyperOffice has a large user base (2M+ workers) with enterprise customers

- They have 6 workflow tools, all of which a user can experience with a free trial

Day-Based Trials

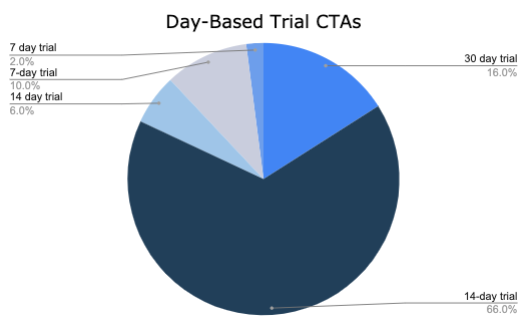

Now, let's dive in deeper. For the companies that are offering day-based CTAs, which of those reigns supreme.

It appears the 14-day trial reigns supreme, followed in a distant second by the 30-day trial. Why? Compared to most consumer facing apps, B2B products typically have a slightly longer time to setup due to the need for integrations, input of data, etc to see value.

What categories of products have a longer trial (14 days, 30-days vs a 7-day trial)?

Frankly, it's pretty varied. That said, the top categories in the 14-day & 30-day trials categories are:

- Cloud Computing

- CRM

- Security Tools

- ML Tools

This makes sense as these platforms broadly have a longer time to value. Now, let's check out what kinds of companies provide 7-day trials.

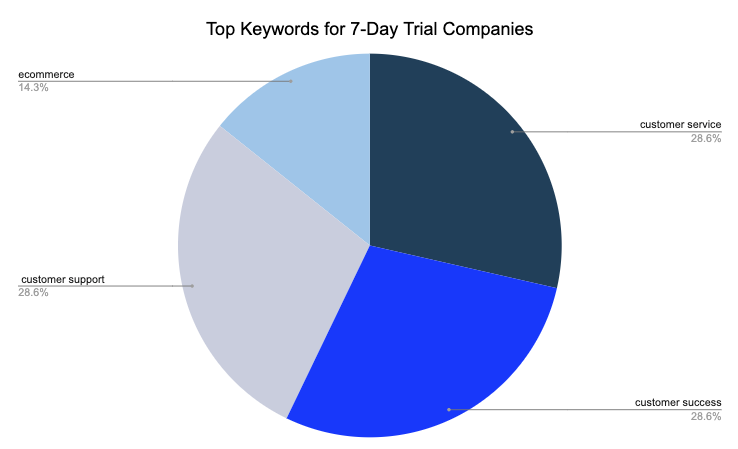

7-Day Trials

The top categories in the 7-day trials categories are:

- Customer Success

- Customer Support

- Customer Service

- E-commerce

That's interesting. It appears that customer-facing software typically has a rapid, trial-based motion. A few example here are gorgias, Front & Cloudtalk

There's likely many factors that contributed to this decision, but both sites promote the rapid setup for users that want to test the software. Generally speaking, these aren't tools with deep integrations or a need for manual data entry. Both tools sit atop existing systems (e-commerce systems & email respectively) and allow the user to see value quickly.

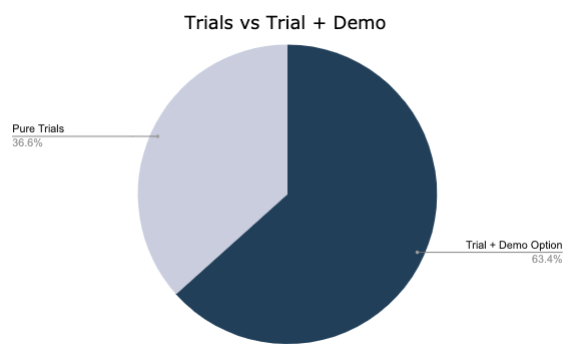

Now, do companies that offer trials have an exclusively self-service sales motion? Or do they also offer the ability for users to request a demo?

Let's see what the data reveals.

~63% of the companies that have a trial-based CTA also offer a demo option. This seems to make sense for a few reasons:

- Not all users have the time/desire to go through a trial and setup the software

- Demos are valuable for information gathering (pricing model, need-feature alignment, customer references, resources, etc)

- The account rep can also bring in technical resources (sales engineering) to ensure the product will be a strong technical fit.

Let's look at an example. As shown in the image below, gorgias offers both. Here, users can easily drop into a trial, or get a live demo.

Demos

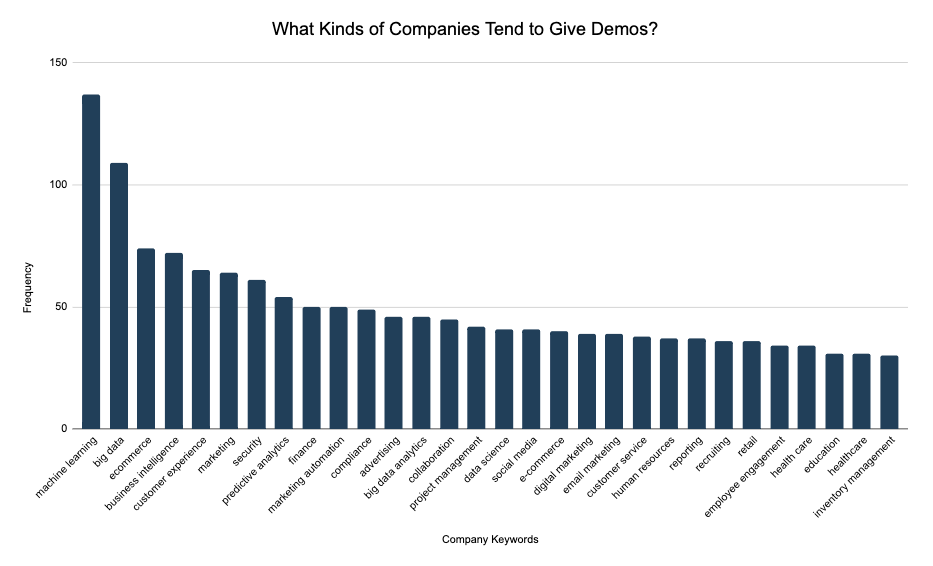

Now, let's look at what kind of companies most frequently have a demo-based sales motion.

In the above chart, we'll notice a few new entrants to our top keywords list. Let's look at some new tools in this category.

- Customer Experience

- Finance

- Compliance

- Education

These keywords often fall into a broader verticals: Customer Experience, EdTech and HRTech. Many companies will have a hard time executing a trial-based sales motion for systems that involve sensitive personal data (HRTech and EdTech) and those that have a lengthy setup time (CX).

Also notice that the following categories of applications are noticeably absent from this category:

- Performance Management

- Application Monitoring

- Developer Tools

- Application Development

While e-commerce may be exempt in some cases, these are typically more complex tools that require either advanced setup or guidance to see the value of the tool.

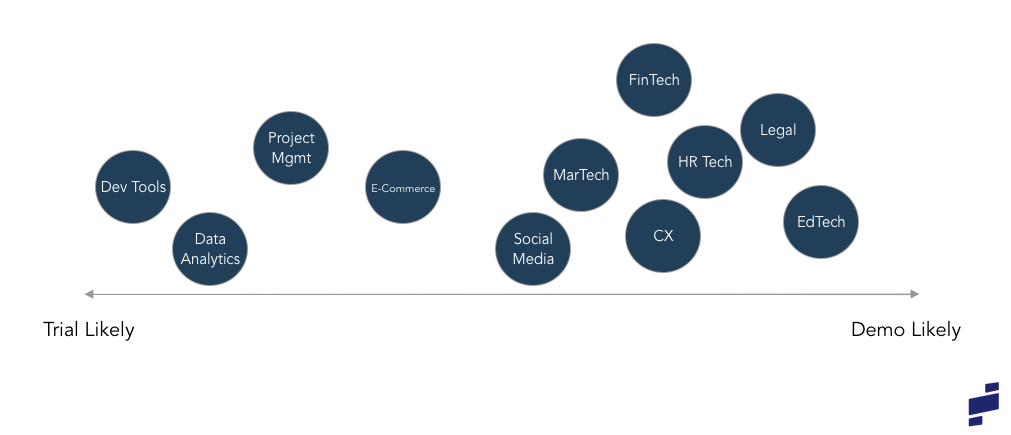

We've compiled this handy spectrum below to help you determine, based on your vertical, what is most common.

We hope this piece offered a helpful data-point to consider when evaluating the prospect product experience.

Looking for more resources? You might be interested in the following pieces:

Have any feedback? Please feel free to shoot us an email at team@navattic.com or send me a message on Linkedin.